ATLANTIC CITY, N.J. — A 2022 exercise by the IRS at a New Jersey university is going viral today as the Trump administration hinted at undoing the weaponization of the Internal Revenue Service and a possible rollback of 86,000 agents approved for hire during the Biden Administration.

Many of those posts are not accurate. They claim the pictures and video from the 2022 event, and one in 2017 depicts IRS agents being trained as part of the Biden IRS surge. They are not. They are from an IRS program called the Adrian Project, which is hosted at many college campuses annually.

While some of the reposts on X remark about the fears of armed IRS agents arresting Americans at gunpoint for trying to cheat on expense deductions, others are questioning Trump’s possible plan to send IRS agents to the U.S. border.

It’s called “The Adrian Project” and, according to the school’s website, is still part of the current curriculum. It is also conducted at other college campuses annually across New Jersey.

We reached out to Stockton for an update.

The event’s imagery released by the IRS and Stockton University appeared to focus more on getting students excited about carrying guns and arresting Americans than calculating deductions and counting dollars. Some X accounts are also reporting, but that was just part of the overall exercise.

While the individuals in the video are college students with no training, many mocked the thought of armed accountants providing border security, using the video as falsely depicting actual IRS agent training as in the video below.

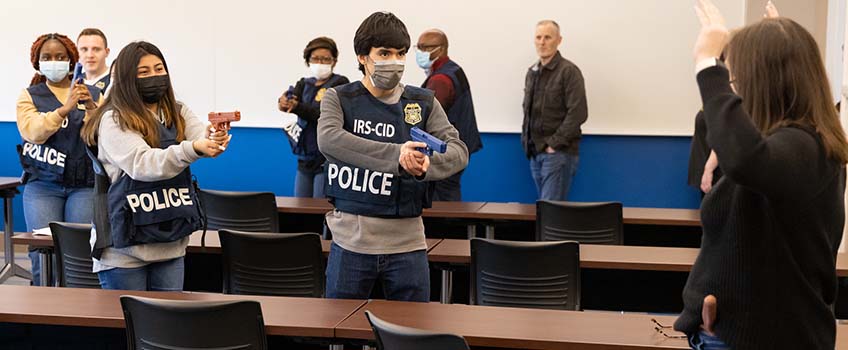

On that day, a group of students at Stockton University experienced the life of an IRS Special Agent during a hands-on simulation hosted by the agency’s Adrian Project. The event, held at the university’s Atlantic City campus, introduced 18 Stockton students and two Ocean City High School students to criminal investigations involving tax law and financial crimes.

The simulation allowed participants to question suspects, analyze financial records, surveil targets, and practice making arrests under the guidance of IRS professionals. One highlight was the takedown of a mock operation linked to terrorist financing. Students also received training on interview techniques, proper use of handcuffs, and how to execute search warrants.

“This is definitely what I want to do,” said Aracelis Nunez, a first-year forensic psychology student from New York City. Many students said they were unaware of career opportunities in the IRS before the event. Associate Professor Barry Palatnik, a former IRS agent, organized the session to expose students to accounting and finance roles beyond traditional office settings.

The Adrian Project showcased the importance of meticulous financial investigations. “You really have to keep your eyes on the financial reports so you can see when the documents don’t match what they are saying,” said senior Kenny Szaniawcki of Brick. Sophomore Mayra Vazquez of Pleasantville added, “Even something very small might turn out to be important, so you have to question everything.”

The event featured practical demonstrations, including an arrest scenario led by Special Agent Kristine Fata, who coordinates use-of-force and firearm training for New Jersey. Students practiced handcuffing techniques, with at least one participant accidentally cuffing himself.

Stockton alumnus and event sponsor Dan Barbera, now a CFO in New York City, said he supported the event to show students the diverse possibilities in accounting careers.

The IRS Adrian Project provided students a rare glimpse into investigative careers, leaving many inspired and informed about the agency’s role in financial enforcement.